Search the

Attendance & Leave

Manual

- 21.1 Sundays & Holidays

- 21.2 Vacation

- 21.3 Sick Leave

- 21.4 Extended Sick Leave

- 21.5 Sick Leave at Half-Pay

- 21.6 Personal Leave

- 21.7 Leave for Extraordinary Weather Conditions

- 21.8 Workers' Compensation Leave

- 21.9 Leave for Subpoenaed Appearance and Jury Attendance

- 21.10 Leave for Civil Service Examinations

- 21.11 Leave for Quarantine

- 21.12 Leaves Required by Law or Negotiated Agreement

- 21.13 Leave for Civil Defense Duties

Drawing of Earned Credits Upon Separation

(Part 23)

- 23.1 Payment for Accruals Upon Separation

- 23.2 Payment for Accruals Upon Entry into Armed Forces

- 23.3 Payment for Overtime Accruals Upon Appointment, Promotion or Transfer

Crediting Other Public Service Employment as State Service (Part 24)

A. Civil Service Attendance Rules

B. Calendar of Legal Holidays & Religious Holy Days

Policy Bulletin No. 1992-01

Section 21.8 Workers' Compensation Leave - July 1, 1992

(Part 1 of

2; pp. 1 - 11)

[Go to Part 2

pp. 12-20]

TO: State Departments and Agencies

FROM: Commissioner Josephine L. Gambino

SUBJECT: Workers' Compensation Items 1991-1995 Negotiated Agreements

Administrative Services Unit (ASU), Institutional Services Unit (ISU),

Operational Services Unit (OSU) and Rent Regulation Services Unit

(RRSU)

The following material has been prepared to assist you in implementing the new workers' compensation provisions contained in the 1991-1995 agreements negotiated with CSEA and DC37. If you have any questions concerning this material, contact the Employee Relations Section of this Department at (518) 457-5167.

TABLE OF CONTENTS (of Part 1 of 2)

- INTRODUCTION

- APPLICABILITY

- THE BENEFIT

[Go to Part 2 pp. 12-20]

ATTACHMENTS

A. Roles and Responsibilities

B. Program Provisions

C. Agency Action Checklist

D. The State Insurance Fund Intake Form

E. State Insurance Fund District Offices

P-1

INTRODUCTION

Effective July 1, 1992, the Workers' Compensation program for State employees represented by CSEA and DC37 will change. In summary, employees who sustain workers' compensation injuries on or after July 1, 1992, will receive the statutory benefit provided by the Workers' Compensation Law (reimbursement for medical expenses and a wage replacement benefit equal to two-thirds of the employee's average weekly wage, not to exceed $400). They will not receive a supplemental payment from their agencies. They will, however, earn leave credits, accrue seniority, receive retirement service credit, have Employee Benefit Fund contributions made on their behalf and be eligible to continue in the health insurance program paying employee share premiums for a period not to exceed 12 months. These employees will not be permitted to charge leave credits (except during the first seven calendar days [five work days] of the statutory waiting period and for partial day absences following return to work). Apart from the waiting period intermittent full-day absences and all periods of continuous absence due to the disability are leave without pay and may not be charged to accrued leave credits.

The following materials contain a detailed description of the new Statutory Benefit Program and guidelines for administration of this program.

The chart entitled "Roles and Responsibilities" (Attachment A) identifies the changes in the roles and responsibilities of the parties involved in administration of the Statutory Benefit Program, as compared to their roles and responsibilities under the previous programs. The chart entitled "Program Provisions" (Attachment B) summarizes the major ways in which the new Statutory Benefit Program differs from both the Supplemental Pay Program and the Workers' Compensation Leave Program.

Also attached is an agency checklist (Attachment C) of steps which need to be taken in processing a claim under the new Statutory Benefit Program. A discussion of what these steps entail is contained in the narrative portion of this bulletin.

It is essential that agencies take great care to ensure that necessary

agency actions are taken in a timely fashion to avoid delays in the

employee's receipt of benefits. It is critical that agencies review

communications from the State Insurance Fund since certain actions

will be required based on these communications.

APPLICABILITY

Employees in Administrative Services Unit (ASU), Institutional Services Unit (ISU), Operational Services Unit (OSU) and the Rent Regulation Services Unit (RRSU) who have Attendance Rules coverage and whose absence is caused by a workers' compensation injury or disease (as defined in the Workers' Compensation Law) from an accident or incident that occurred on or after July 1, 1992 are eligible for coverage under the Statutory Benefit Program. (Although not subject to the Attendance Rules, the Division of Military and Naval Affairs [DMNA] CSEA unit employees are also covered by the Statutory Benefit Program.) Employees without Attendance Rules coverage continue to receive the benefits required by the Workers' Compensation Law but are not subject to the provisions of the contract articles or the Attendance Rules.

Annual salaried full-time and part-time employees (including those employed on; a seasonal basis) who have Attendance Rules coverage are eligible for this benefit. Full-time and part-time employees (including those employed on a seasonal basis) who are paid on an hourly or per diem basis must have gained Attendance Rules coverage, by having completed the required 19 qualifying biweekly pay periods, prior to becoming eligible for this benefit. However, once Rule coverage is attained, these employees' benefits are identical to those available to annual salaried employees.

For the purpose of entitlement to any employer-provided workers' compensation benefits, the State of New York is considered to be one employer. Therefore, if an employee has a work-related injury or disease from employment with agency A, moves to agency B and is again absent for the same condition, agency B must provide such employee with any benefit not already used at agency A and, therefore, still available for this injury or disease. Likewise, if a person works for two State agencies and incurs an occupational injury at one of them, the employee must be given leave benefits by both employers, to the extent he/she is eligible. The benefits provided by each employer must be added together to determine how much of the total available benefit has been used by the employee.

The eligible employee's entitlement to either the Workers' Compensation Leave Program, Supplemental Pay Program or Statutory Benefit Program is determined by both the date of the accident and the bargaining unit to which the employee was assigned on the date of the accident. For example, an eligible employee is injured on October 1, 1988 while in the Security Services Unit. He/she...

...changes jobs on October 15, 1988 and is in an Institutional Services Unit position. On November 3, 1988, the employee begins losing time from work due to the October 1, 1988 accident. This employee is eligible for the Workers' Compensation Leave benefit for any disability related to the October 1, 1988 accident because the absence is due to an incident that occurred while subject to the provisions of the Security Services Unit agreement. Any incidents which occurred between April 1, 1986 and June 30, 1992 while he/she is an Institutional Services Unit employee will be subject to the provisions of the Supplemental Pay Program and those that occur after July 1, 1992 (if he/she remains in the Institutional Services Unit) will be subject to the Statutory Benefit Program.

THE BENEFIT

Waiting Period

- No wage replacement benefit is payable if the absence due

to a workers' compensation injury or disease does not

exceed seven calendar days. - If absence is for at least eight calendar days, but does

not exceed 14 calendar days, wage replacement benefits

are payable beginning with the eighth calendar day of

disability. - Once absence due to a single injury or disease exceeds 14 calendar days, wage replacement benefits are payable retroactively to the first day of disability.

Employees are allowed to charge available leave credits only during the first seven calendar days (five work days) of the waiting period. (If the employee is unable to notify the agency of his/her option to charge leave accruals during the waiting period, the agency should assume the employee wants to charge accruals. In such cases, adjustments should be made retroactively if it is subsequently determined that the employee did not want to charge credits.) Sick leave credits should be charged first before other categories of leave.

Employees may not be advanced leave to cover this period; however, eligible employees who have exhausted their leave accruals must, upon request, be granted sick leave at half-pay during the waiting period. Employees are eligible to be granted sick leave at half-pay under the Attendance Rules if they are permanent non-probationary employees who have completed one cumulative year of...

...state service; contractual waiting periods for mandatory sick leave at half-pay do not apply. The agency submits a PR-75 placing the employee on workers' compensation disability leave without pay effective the eighth calendar day of disability. The employee will receive wage replacement benefits from the State Insurance Fund (SIF) beginning with the eighth day.

If the employee elects not to use leave credits or does not request use of sick leave at half-pay, the agency places the employee on workers' compensation disability leave without pay effective the first day of disability and the employee will receive wage replacement benefits from the SIF beginning with the first day of disability once the disability exceeds 14 calendar days.

Once the absence due to a single injury or disease is for 15 calendar days or more, wage replacement benefits from SIF are payable retroactively to the first day of disability; the employee remains on workers' compensation disability leave without pay for the duration of disability. The employee whose absence goes beyond the 15 calendar days will have the credits he/she charged during the initial seven calendar days restored (not recredited) on a prorated basis following a Workers' Compensation Board Notice of Decision crediting New York State with the wage replacement. (See Restoring Leave Credits below for further information.)

The first day of compensable lost time for the purpose of calculating the waiting period and eligibility for benefits is determined by SIF who will inform the agency of this date upon acceptance of the claim. The appointing authority, when reporting an accident or incident to SIF, must include the time and date of the accident/incident.

The Workers' Compensation Law statutory waiting period is applied only once per injury or disease and is met by cumulating the employee's absences in full days.

Benefit Status

A disabled employee is placed on workers' compensation disability

leave without pay at the end of the seven calendar day waiting period

if the employee elected to charge leave credits or as of the first

day of disability if the employee did not elect to charge leave credits.

The employee continues on workers' compensation disability leave

without pay for the duration of the absence and is placed in no

pay status for all other full day absences related to the incident

which occur after return to work.

Refer to Office of the State Comptroller Payroll Bulletin P-734 dated July 12, 1992, for more detailed information on processing these transactions.

While an employee is absent on workers' compensation disability leave without pay and receiving compensation benefits from the State Insurance Fund, the employee is treated as though in full pay status for the purpose of accruing biweekly leave accruals, continuous service, retirement service credit, Employee Benefit Fund contributions and health insurance for up to 12 cumulative months of absence. (See Earning of Leave Accruals below for further information on leave accruals.)

Although the employee is treated as though he/she were in full pay status for certain benefit purposes, the employee is on leave without pay for salary purposes, and the agency has no further financial obligation to the employee until the employee returns to work.

Retirement

The employee will be responsible for payment of the employee contribution (where applicable) to the retirement system and the State will continue its contribution. These contributions will be made by the employee via payroll deduction when the employee returns to duty and full pay. Refer to the Employees' Retirement System memorandum for an explanation of this process.

Health Insurance

Health insurance coverage for the employee and his/her dependents (as applicable) will continue. The employee will be responsible for payment of the regular biweekly employee share of the health insurance premium, however, these payments will be deferred until the employee returns to the payroll. For detailed information on health insurance issues refer to the "Memorandum to Agency Health Benefits Administrators # NY 92-19."

Other Deductions

While the employee is in leave without pay status, the employee is responsible for making direct payment for any other payroll deductions (e.g., life insurance, credit union). Refer to Attendance and Leave Manual General Information Bulletin No. 90-02, issued November 30, 1990, for information on who to contact regarding making direct payments for credit unions, CSEA...

...insurances, deferred compensation, individual retirement accounts and any other authorized payroll deductions.

Earning of Leave Accruals

Employees who are on workers' compensation disability leave without pay earn biweekly sick leave and vacation credits for up to 12 cumulative months of absence. For purposes of determining eligibility to earn biweekly leave accruals, a day of workers' compensation disability leave without pay is treated as though it were a day in full pay status. This is true whether the day falls during a period of continuous or intermittent absence. Under the Attendance Rules, employees whose normal work schedule is 10 days in a payroll period must complete a minimum of seven full days out of 10 in full pay status in order to be eligible to earn leave accruals for that payroll period. A day of workers' compensation disability leave without pay counts as a day toward meeting that seven-day eligibility threshold just as do days worked or charged to leave accruals.

For example, a full-time employee absent for four intermittent days of workers' compensation disability leave without pay who works the remaining six days in that payroll period earns his/her normal biweekly accruals as a full-time employee for that payroll period as does the full-time employee who is absent for 10 days on workers' compensation disability leave without pay. Similarly, a 60 percent part-time employee with a normal schedule of six days per biweekly pay period who is absent for three intermittent days of workers' compensation disability leave without pay and works the remaining three days in that payroll period earns his/her normal biweekly accruals (i.e., 60 percent of the full-time accruals) for that payroll period as does the 60 percent employee who is absent for six days on workers' compensation disability leave without pay.

Personal Leave

Employees who are on workers' compensation disability leave without pay on their personal leave anniversary date are credited with their personal leave days on that date.

Vacation Bonus Days

Employees who are on workers' compensation disability leave without pay on their vacation anniversary date are credited with any vacation bonus days or additional vacation days for which they are otherwise eligible.

P-7Holidays

Employees on workers' compensation disability leave without pay are not eligible to observe holidays except those that fall during the initial 7 calendar day waiting period and only if they elect to charge leave credits. If a holiday falls during the seven calendar day waiting period, an employee charging leave credits charges one day less if the holiday coincides with a workday or is credited with holiday leave for a holiday which coincides with the employee's pass day (regular day off).

Employees on workers' compensation disability leave without pay are eligible to be credited with floating holidays which fall any time during that leave. If the floating holiday falls during the waiting period, the employee who is charging credits charges the day to other accrued leave and accrues the floating holiday (or, with agency permission, may charge the floating holiday on the day it is earned).

Accrual Maximums

Employees continue to be subject to provisions on maximums for accrual of vacation and sick leave credits and expiration dates for personal leave, floating holidays and, in the ASU and OSU, holiday leave. Refer to the appropriate sections of the Attendance and Leave Manual for clarification as to what these limits are. While an employee is on workers' compensation disability leave without pay, leave credits cannot be accrued above established maximums nor can they be carried beyond the date on which they would otherwise lapse. Please note, however, that whenever an employee in one of the CSEA units is absent under this program, he/she is considered to have invoked the contract provisions which allow exceeding the 40-day vacation maximum and, therefore, must be allowed to accumulate vacation beyond the maximum until the following March 31. Employees in the RRSU can always exceed 40 days except on April 1 of each year. For both the CSEA units and RRSU, excess vacation credits must be forfeited on April 1. (See Restoring Leave Accruals for a discussion of the impact of restoration on accrual maximums and expiration dates.)

Charging Leave Accruals

Employees absent from work due to a workers' compensation disability may charge any available leave accruals during the initial seven calendar day (five work day) waiting period. Sick leave credits should be charged first before other categories of leave accruals. If sufficient leave credits are not available, the...

...eligible employee must, upon request, be granted sick leave at half-pay. (See page 3 for eligibility criteria.) However, there are no provisions for advancing of leave accruals under this program. Leave credits used or sick leave at half-pay granted during this initial waiting period are not recredited to the employee. There are no provisions for recrediting of leave accruals used at any time under this program. (Refer to Restoring Leave Accruals for further information.)

Once the seven calendar day period has passed, the employee is placed on workers' compensation disability leave without pay and cannot charge leave accruals or be granted sick leave at half-pay.

Employees may charge leave credits for partial day absences following return to work. However, employees are not permitted to charge leave accruals for full days of intermittent absence following return to work.

When a case is controverted because SIF does not find the disability to be job-related but agrees that the employee is disabled, the employee is permitted to charge the absence to leave credits. Any requests to charge accrued leave credits under these circumstances should be made in accordance with normal agency procedures for use of leave credits. However, when a case is contested because the employee is found to be not disabled, the employee is placed on unauthorized leave without pay pending return to work and is not permitted to charge leave credits.

Sick Leave at Half-Pay

Time spent on workers' compensation disability leave without pay counts as time worked for purposes of calculating an employee's maximum available sick leave at half-pay entitlement. For example, an otherwise eligible employee on workers' compensation disability leave without pay for six months earns an additional payroll period of sick leave at half-pay eligibility.

Employees absent under the Statutory Benefit Program are not permitted to use sick leave at half-pay except when they would be permitted to charge leave accruals, if available, for full day absences (see Charging Leave Accruals).

Restoring Leave Accruals

Under the Statutory Benefit Program, leave accruals charged are restored to the employee on a prorated basis only following a Notice of Decision by the Workers' Compensation Board (WCB)...

...crediting New York State for wages paid. There is no recrediting of leave accruals under the Statutory Benefit Program.

The restoration of leave credits is proportional, based on the credit New York State receives from the State Insurance Fund. The information needed to determine the proportion of credits to be restored is obtained from the C-8 form issued by the State Insurance Fund following a Workers' Compensation Board hearing. Contact your agency's regular claims examiner at the State Insurance Fund upon receipt of the C-8 to verify the number of days for which New York State received credit and the total net dollar amount credited to NYS (the total net credit is the total dollar credit to NYS minus any deductions authorized by the WCB). Using these figures and the employee's normal biweekly gross salary at the time of the accident, a percentage of proration of credits to be restored is calculated.

The following procedure explains this process:

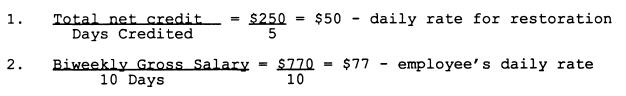

- Divide the total net credit by the number of days credited to obtain the daily rate for restoration;

- Divide the employee's normal biweekly gross salary at the time of the accident by 10 to obtain the employee's daily rate (for purposes of proration we are using this simplified version of the daily rate);

- Divide the daily rate for restoration by the employee's daily

rate and multiply by 100 to obtain the proration percentage;

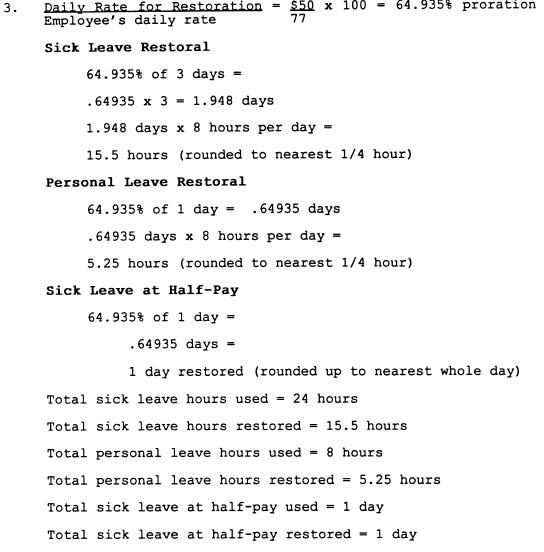

This proration percentage is then applied separately to each category of leave credits charged by the employee to determine the number of days of leave in each category to be restored. (NOTE - the amount of restored credits cannot exceed the actual number of credits charged;) - Convert the number of days to be restored to hours by multiplying the number of days by either 7.5 or 8 as applicable;

- Round the number of hours up to the nearest quarter hour;

- Sick leave at half-pay eligibility is restored in the same manner.

However, there is no conversion to hours, the days restored are

rounded up to the nearest whole day.

In each case, the employee will be restored a percentage of the number of days charged and/or sick leave at half-pay granted during the period covered by the Workers' Compensation Board award. Except in controverted cases, most restorations will involve only those credits charged during the 7 calendar day initial waiting period for employees whose disability extends beyond 14 calendar days. An exception will occur for employees whose absence does not extend beyond 14 calendar days who receive a schedule loss award. Under Workers' Compensation Law, certain disabilities require the employee to receive an award of a specific number of days of compensation (which are listed on a schedule in the Law) without regard to the number of days actually lost from work due to the injury. In the case of a schedule loss award, the employee will have any credits charged during the initial waiting period restored on a prorated basis because New York State will receive a credit for wages paid.

Credits restored cannot be used again in connection with absences attributable to the same accident or injury. When restoration of leave accruals causes the employee to exceed applicable maximums for vacation and/or sick leave, the employee has one year from restoration of credits or return to work, whichever is later, to reduce accruals below applicable maximums. During this period of time, the employee continues to earn vacation and sick leave. There is no restoration of expired personal leave, holiday leave or floating holidays.

Example:

An employee charged 4 days of leave accruals, (3 days of sick leave and 1 day of personal leave) and was granted 1 day of sick leave at half-pay, upon exhaustion of credits, to cover the initial waiting period following a workers' compensation injury.

After the WCB hearing, the C-8 from the SIF detailed a credit to NYS of a total of 5 days (1 week) with a net monetary credit of $250 ($350 minus $100 attorney's fee). The employee's biweekly gross salary is $770. The basic workweek of this employee is 40 hours.

Eligibility for Overtime

For purposes of determining whether an employee has met the 40-hour per week threshold for eligibility for overtime compensation, time spent on workers' compensation disability leave...